Types of Business Structures in Singapore

As you decide to incorporate your business in Singapore, you will have to select the business structure that best suits your needs. This article provides an overview of the different business entity structures allowed in Singapore and explains why a limited liability company is the best choice for most businesses.

For both local and foreign businesses, Singapore ranks as one of the best locations to incorporate. But which structure is right for your company?

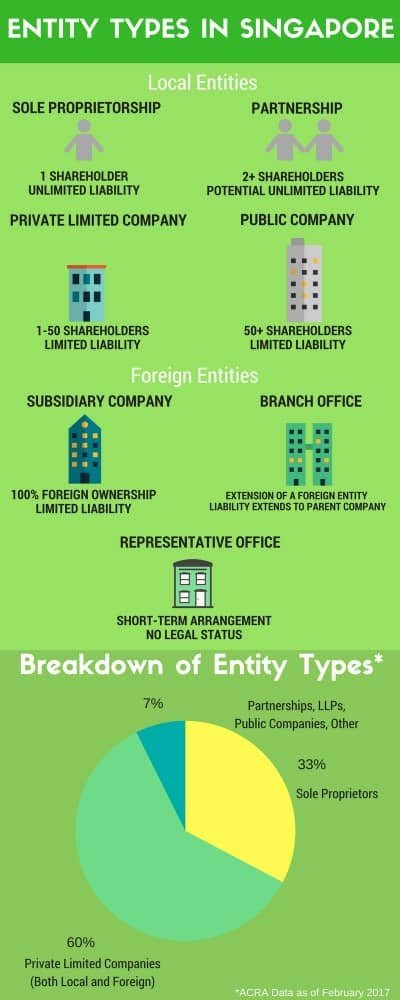

Below are the different business structures that are available in Singapore to an entrepreneur.

Limited Liability Companies

Under Singapore Companies Act, a limited liability company may be incorporated as a:

Private Company Limited by Shares

Public Company Limited by Shares

Public Company Limited by Guarantee

PRIVATE COMPANY LIMITED BY SHARES

A private company limited by shares is often referred to as a “private limited company”. A private limited company has between 1 and 50 shareholders, who can be private individuals or corporations. As of 2018, approximately 65% of all companies in Singapore operate as private limited companies. This type of company is also the most appropriate for those who intend to launch an IT business in Singapore.

Of the more than 500,000 businesses in Singapore, over 300,000 are incorporated as a private limited company.Singapore Government Statistics

Why are most businesses structured as private limited companies?

1. Separate Legal Entity with Limited Liability

A private limited company has its own legal identity separate from its shareholders and directors, allowing it to enter into contracts, acquire assets, go into debt and sue and be sued in its own name.As a result, the liability of the company’s shareholders is limited to the amount used to purchase shares in the company. Their private assets cannot be used to pay off the private limited company’s debts or liabilities; such debts stop at the company.

2. Tax Benefits

In Singapore, the effective corporate tax rate is below 9% for companies with profits up to SGD 300,000 and a flat 17% for profits above SGD 300,000. In addition, there is no capital gains tax.Moreover, companies do not pay any dividend tax due to Singapore’s single-tier tax system. Once income has been taxed at the corporate level, dividends are distributed to shareholders tax-free. All of these tax benefits are available to a private limited company.

3. Ease of Raising Capital to Expand Your Business:

You can raise capital by issuing additional shares to current shareholders or by bringing in new shareholders without having to change the structure of your business. This is not readily possible with some of the other corporate structures.

4. Ease of Transfer of Ownership and Perpetual Succession:

Ownership in the company can be transferred easily through the sale of shares. That means the business existence does not rely on the continued membership of any member. If a shareholder dies or resigns, the business can continue to thrive. This is not possible in the case of some of the other structures.

5. Credibility:

Investing the time and effort in setting up a company tells potential employees, customers, suppliers, partners and investors that you are running a serious and scalable business.

For more information on the procedure for registering a company, see How to Register a Singapore Company.

PUBLIC COMPANY LIMITED BY SHARES

A public company limited by shares has more than 50 shareholders making it the appropriate structure for large, well-established business who want to raise capital by offering shares of the company to the public.

Public companies must register with the Monetary Authority of Singapore and face heavy regulation. They also have extensive compliance and reporting requirements and as such are significantly more expensive to set up and maintain.

PUBLIC COMPANY LIMITED BY GUARANTEE

A public company limited by guarantee is only for non-profit organizations engaged in work for the national or public interest, such as charity or art. As such, this form of legal structure is not discussed in this article.

Options for Foreign Companies

Most foreign companies establish a subsidiary company in Singapore

A foreign company that wishes to establish an office in Singapore can establish one of the following entities:

A limited liability company known as a subsidiary company

A branch office

A representative office

SUBSIDIARY COMPANY

Foreign companies can establish a local limited liability company in Singapore, known as a subsidiary company. They can also set up a branch office or a representative office.

However, a subsidiary company is the most common business structure for establishing an entity by foreign companies.

The subsidiary acts as a separate legal entity from the parent entity thereby allowing the following benefits:

1. Since the subsidiary is a separate legal entity, therefore, the parent company is protected from the liabilities of the subsidiary.

2. A Foreign company can be the 100% shareholder in the subsidiary:

3. Subsidiaries can take advantages of the same tax incentives and exemptions available to Singapore resident companies.

4. Such a structure imposes simpler compliance requirements such as the financial statements of the parent company are not required to be filed. This is not the case with some of the other options.

For more details, see our article How to Register a Singapore Subsidiary.

BRANCH OFFICE

A branch office is an extension of the foreign parent company, not a separate legal entity, meaning its liabilities extend to the parent company.

There are no practical benefits of setting up a branch office over a subsidiary company. Consequently most foreign companies opt to establish a subsidiary company in Singapore.

For more details, see our article How to Register a Singapore Branch Office.

REPRESENTATIVE OFFICE

A representative office is only a short-term arrangement with a limited purpose. It has no legal status and is designed only for conducting market research or engaging in promotional activities.

A representative office cannot engage in business, enter into contracts, move goods, offer services or open a line of credit.

Setting up a representative office may make sense in certain situations where a foreign company is not yet ready to establish a permanent office.

Note, however, that the application to set up a representative office is subject to review and approval by government authorities.

For more, see our article How to Register a Representative Office in Singapore.

Partnerships

Singapore allows three types of partnerships:

General Partnership

Limited Partnership

Limited Liability Partnership (LLP)

GENERAL PARTNERSHIP

A general partnership can have between two and twenty partners. Similar to a sole proprietorship, each partner in a general partnership is personally liable for all the debts and liabilities of the business.

LIMITED PARTNERSHIP

A limited partnership allows general partners to add limited partners to the organizational structure. Small to medium sized enterprises generally avoid the Limited Partnership structure for two reasons:

The general partner holds complete control of the management of the company but also assume personal liability for the debts and liabilities of the business.

The limited partners only have personal liability for the amount they invested in the business, but cannot participate in the management of the business.

LIMITED LIABILITY PARTNERSHIP

A limited liability partnership (LLP) is a hybrid of a partnership and an incorporated company.

A partner in an LLP is not personally liable for all of the debts and liabilities of the business, only those arising from his or her own negligence or personal misconduct. As a result, the partner’s liability is considered “limited.”

Nonetheless, an LLP lacks the other advantages that come with incorporating a private limited company.

Typically, an LLP is employed by a group of two or more professionals, such as doctors, accountants, attorneys or architects, who wish to build a joint practice.

Sole Proprietorship

A sole proprietorship is the simplest but riskiest business entity allowed in Singapore. A sole proprietorship is not considered a separate legal entity and comes with significant disadvantages for small to medium sized enterprises:

If a sole-proprietorship is sued or cannot pay its bills, the owner must pay out of his personal assets.

Only a single owner can set up a sole-proprietorship. New equity holders cannot join the structure as the business grows and scales.

Serious investors almost never invest in a sole-proprietorships.

Sole proprietors have a poor perception among customers, suppliers, bankers, and staff.

They do not have perpetual existence. The business lives and dies with the owner.

It is often difficult to sell a sole-proprietorship.

Most of the tax benefits available to corporations are not available to sole proprietorships. Also, your effective tax rate will be higher than that for a private limited company.

Which entity is right for you?

For small to medium sized businesses, a private limited company is the most suitable structure. It offers superior tax benefits, is easy to transfer and limits your liability from your business.

For foreign companies, a subsidiary company provides the best liability protection and tax benefits.

Ready to take the next step?

Ready to setup your company?